Item specifics

-

Condition

-

-

Brand

-

Unbranded

-

MPN

-

Does not apply

-

ISBN

-

9780375758256

-

Book Title

-

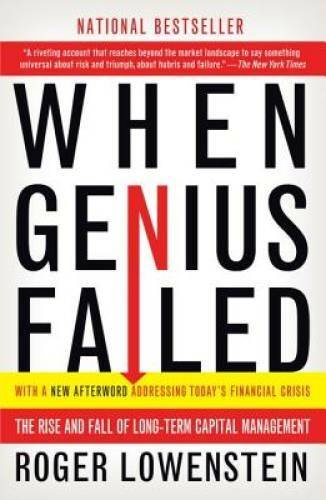

When Genius Failed : the Rise and Fall of Long-Term Capital Management

-

Publisher

-

Random House Publishing Group

-

Item Length

-

8 in

-

Publication Year

-

2001

-

Format

-

Trade Paperback

-

Language

-

English

-

Item Height

-

0.6 in

-

Genre

-

Business & Economics

-

Topic

-

Banks & Banking, Finance / Financial Risk Management, Industries / Financial Services, Corporate Finance / General, Corporate & Business History, Investments & Securities / General

-

Item Weight

-

7.7 Oz

-

Item Width

-

5.2 in

-

Number of Pages

-

304 Pages

When Genius Failed: The Rise and Fall of Long-Term Capital Management – GOOD

About this product

Product Identifiers

Publisher

Random House Publishing Group

ISBN-10

0375758259

ISBN-13

9780375758256

eBay Product ID (ePID)

1932070

Product Key Features

Book Title

When Genius Failed : the Rise and Fall of Long-Term Capital Management

Number of Pages

304 Pages

Language

English

Publication Year

2001

Topic

Banks & Banking, Finance / Financial Risk Management, Industries / Financial Services, Corporate Finance / General, Corporate & Business History, Investments & Securities / General

Genre

Business & Economics

Format

Trade Paperback

Dimensions

Item Height

0.6 in

Item Weight

7.7 Oz

Item Length

8 in

Item Width

5.2 in

Additional Product Features

Intended Audience

Trade

LCCN

00-028091

Dewey Edition

21

Reviews

“A riveting account that reaches beyond the market landscape to say something universal about risk and triumph, about hubris and failure.”– The New York Times “[Roger] Lowenstein has written a squalid and fascinating tale of world-class greed and, above all, hubris.”– Business Week “Compelling . . . The fund was long cloaked in secrecy, making the story of its rise . . . and its ultimate destruction that much more fascinating.”– The Washington Post “Story-telling journalism at its best.”– The Economist, “A riveting account that reaches beyond the market landscape to say something universal about risk and triumph, about hubris and failure.”– The New York Times “[Roger] Lowenstein has written a squalid and fascinating tale of world-class greed and, above all, hubris.”– Business Week “Compelling . . . The fund was long cloaked in secrecy, making the story of its rise . . . and its ultimate destruction that much more fascinating.”– The Washington Post “Story-telling journalism at its best.”– The Economist, “A riveting account that reaches beyond the market landscape to say something universal about risk and triumph, about hubris and failure.”- The New York Times “[Roger] Lowenstein has written a squalid and fascinating tale of world-class greed and, above all, hubris.”- Business Week “Compelling . . . The fund was long cloaked in secrecy, making the story of its rise . . . and its ultimate destruction that much more fascinating.”- The Washington Post “Story-telling journalism at its best.”- The Economist

Dewey Decimal

332.6

Synopsis

“A riveting account that reaches beyond the market landscape to say something universal about risk and triumph, about hubris and failure.”– The New York Times NAMED ONE OF THE BEST BOOKS OF THE YEAR BY BUSINESSWEEK In this business classic–now with a new Afterword in which the author draws parallels to the recent financial crisis–Roger Lowenstein captures the gripping roller-coaster ride of Long-Term Capital Management. Drawing on confidential internal memos and interviews with dozens of key players, Lowenstein explains not just how the fund made and lost its money but also how the personalities of Long-Term’s partners, the arrogance of their mathematical certainties, and the culture of Wall Street itself contributed to both their rise and their fall. When it was founded in 1993, Long-Term was hailed as the most impressive hedge fund in history. But after four years in which the firm dazzled Wall Street as a $100 billion moneymaking juggernaut, it suddenly suffered catastrophic losses that jeopardized not only the biggest banks on Wall Street but the stability of the financial system itself. The dramatic story of Long-Term’s fall is now a chilling harbinger of the crisis that would strike all of Wall Street, from Lehman Brothers to AIG, a decade later. In his new Afterword, Lowenstein shows that LTCM’s implosion should be seen not as a one-off drama but as a template for market meltdowns in an age of instability–and as a wake-up call that Wall Street and government alike tragically ignored. Praise for When Genius Failed “[Roger] Lowenstein has written a squalid and fascinating tale of world-class greed and, above all, hubris.” –BusinessWeek “Compelling . . . The fund was long cloaked in secrecy, making the story of its rise . . . and its ultimate destruction that much more fascinating.” — The Washington Post “Story-telling journalism at its best.” — The Economist, “A riveting account that reaches beyond the market landscape to say something universal about risk and triumph, about hubris and failure.”– The New York Times NAMED ONE OF THE BEST BOOKS OF THE YEAR BY BUSINESSWEEK In this business classic–now with a new Afterword in which the author draws parallels to the recent financial crisis–Roger Lowenstein captures the gripping roller-coaster ride of Long-Term Capital Management. Drawing on confidential internal memos and interviews with dozens of key players, Lowenstein explains not just how the fund made and lost its money but also how the personalities of Long-Term’s partners, the arrogance of their mathematical certainties, and the culture of Wall Street itself contributed to both their rise and their fall. When it was founded in 1993, Long-Term was hailed as the most impressive hedge fund in history. But after four years in which the firm dazzled Wall Street as a $100 billion moneymaking juggernaut, it suddenly suffered catastrophic losses that jeopardized not only the biggest banks on Wall Street but the stability of the financial system itself. The dramatic story of Long-Term’s fall is now a chilling harbinger of the crisis that would strike all of Wall Street, from Lehman Brothers to AIG, a decade later. In his new Afterword, Lowenstein shows that LTCM’s implosion should be seen not as a one-off drama but as a template for market meltdowns in an age of instability–and as a wake-up call that Wall Street and government alike tragically ignored. Praise for When Genius Failed ” Roger] Lowenstein has written a squalid and fascinating tale of world-class greed and, above all, hubris.” –BusinessWeek “Compelling . . . The fund was long cloaked in secrecy, making the story of its rise . . . and its ultimate destruction that much more fascinating.” — The Washington Post “Story-telling journalism at its best.” — The Economist

LC Classification Number

HG4930 .L69 2000

Price : 4.47

Ends on : N/A

View on eBay