Item specifics

-

Condition

-

-

Brand

-

Unbranded

-

MPN

-

Does not apply

-

ISBN

-

9780062467270

-

Book Title

-

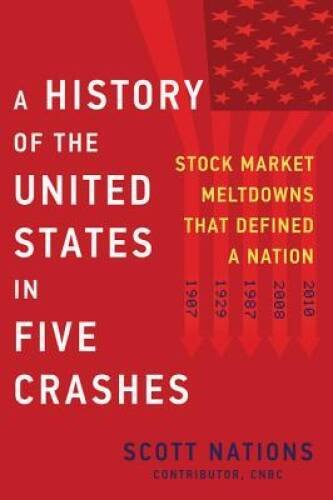

History of the United States in Five Crashes : Stock Market Meltdowns That Defined a Nation

-

Publisher

-

HarperCollins

-

Item Length

-

9 in

-

Publication Year

-

2017

-

Format

-

Hardcover

-

Language

-

English

-

Item Height

-

1.1 in

-

Genre

-

Political Science, Business & Economics

-

Topic

-

Economic History, International Relations / Trade & Tariffs, Motivational, Economic Conditions, Investments & Securities / Stocks

-

Item Weight

-

17.5 Oz

-

Item Width

-

6 in

-

Number of Pages

-

352 Pages

A History of the United States in Five Crashes: Stock Market Meltdow – VERY GOOD

About this product

Product Identifiers

Publisher

HarperCollins

ISBN-10

0062467271

ISBN-13

9780062467270

eBay Product ID (ePID)

229441911

Product Key Features

Book Title

History of the United States in Five Crashes : Stock Market Meltdowns That Defined a Nation

Number of Pages

352 Pages

Language

English

Publication Year

2017

Topic

Economic History, International Relations / Trade & Tariffs, Motivational, Economic Conditions, Investments & Securities / Stocks

Genre

Political Science, Business & Economics

Format

Hardcover

Dimensions

Item Height

1.1 in

Item Weight

17.5 Oz

Item Length

9 in

Item Width

6 in

Additional Product Features

Intended Audience

Trade

LCCN

2017-033698

Reviews

My hands-down financial book of the year. … An incredibly rich mine of market history. … Enlightening. … Meticulous. … Definitive. … Absolutely first class., The names of the stocks may change, as will the faces of the traders from one generation to the next. But through all of the social and technological evolution America has undergone, one thing remains exactly the same: The timeless and permanent dichotomy of fear and greed. By pulling together the common threads of each infamous crash, and providing the societal context unique to each, Scott Nations has done something truly entertaining and extraordinary for his readers., “Excellent. … A pleasure to read.” — Wall Street Journal “My hands-down financial book of the year. … An incredibly rich mine of market history. … Enlightening. … Meticulous. … Definitive. … Absolutely first class.” — Financial Advisor Magazine “Absorbing. … Nations’s stylish writing gives these stories of greed and fear a cliffhanger momentum.” — Financial Advisor Magazine “Timely. … An eye-opening examination of the many ways money can be made–and disappear.” — Kirkus Reviews “Fascinating. … Uniquely helpful.” — Publishers Weekly “A fast-paced narrative… Lively style… Entertaining and informative.” — Library Journal

TitleLeading

A

Synopsis

In this absorbing, smart, and accessible blend of economic and cultural history, Scott Nations, a longtime trader, financial engineer, and CNBC contributor, takes us on a journey through the five significant stock market crashes in the past century to reveal how they defined the United States today. The Panic of 1907: When the Knickerbocker Trust Company failed, after a brazen attempt to manipulate the stock market led to a disastrous run on the banks, the Dow lost nearly half its value in weeks. Only billionaire J. P. Morgan was able to save the stock market. Black Tuesday (1929): As the newly created Federal Reserve System repeatedly adjusted interest rates in all the wrong ways, investment trusts, the darlings of that decade, became the catalyst that caused the bubble to burst, and the Dow fell dramatically, leading swiftly to the Great Depression. Black Monday (1987): When “portfolio insurance,” a new tool meant to protect investments, instead led to increased losses, and corporate raiders drove stock prices above their real values, the Dow dropped an astonishing 22.6 percent in one day. The Great Recession (2008): As homeowners began defaulting on mortgages, investment portfolios that contained them collapsed, bringing the nation’s largest banks, much of the economy, and the stock market down with them. The Flash Crash (2010): When one investment manager, using a runaway computer algorithm that was dangerously unstable and poorly understood, reacted to the economic turmoil in Greece, the stock market took an unprecedentedly sudden plunge, with the Dow shedding 998.5 points (roughly a trillion dollars in valuation) in just minutes. The stories behind the great crashes are Filled with drama, human foibles, and heroic rescues. Taken together they tell the larger story of a nation reaching enormous heights of financial power while experiencing precipitous dips that alter and reset a market where millions of Americans invest their savings, and on which they depend for their futures. Scott Nations vividly shows how each of these major crashes played a role in America’s political and cultural fabric, each providing painful lessons that have strengthened us and helped us to build the nation we know today. A History of the United States in Five Crashes clearly and compellingly illustrates the connections between these major financial collapses and examines the solid, clear-cut lessons they offer for preventing the next one., In this absorbing, smart, and accessible blend of economic and cultural history, Scott Nations, a longtime trader, financial engineer, and CNBC contributor, takes us on a journey through the five significant stock market crashes in the past century to reveal how they defined the United States today The Panic of 1907: When the Knickerbocker Trust Company failed, after a brazen attempt to manipulate the stock market led to a disastrous run on the banks, the Dow lost nearly half its value in weeks. Only billionaire J.P. Morgan was able to save the stock market. Black Tuesday (1929): As the newly created Federal Reserve System repeatedly adjusted interest rates in all the wrong ways, investment trusts, the darlings of that decade, became the catalyst that caused the bubble to burst, and the Dow fell dramatically, leading swiftly to the Great Depression. Black Monday (1987): When “portfolio insurance,” a new tool meant to protect investments, instead led to increased losses, and corporate raiders drove stock prices above their real values, the Dow dropped an astonishing 22.6 percent in one day. The Great Recession (2008): As homeowners began defaulting on mortgages, investment portfolios that contained them collapsed, bringing the nation’s largest banks, much of the economy, and the stock market down with them. The Flash Crash (2010): When one investment manager, using a runaway computer algorithm that was dangerously unstable and poorly understood, reacted to the economic turmoil in Greece, the stock market took an unprecedentedly sudden plunge, with the Dow shedding 998.5 points (roughly a trillion dollars in valuation) in just minutes. The stories behind the great crashes are filled with drama, human foibles, and heroic rescues. Taken together they tell the larger story of a nation reaching enormous heights of financial power while experiencing precipitous dips that alter and reset a market where millions of Americans invest their savings, and on which they depend for their futures. Scott Nations vividly shows how each of these major crashes played a role in America’s political and cultural fabric, each providing painful lessons that have strengthened us and helped us to build the nation we know today. A History of the United States in Five Crashes clearly and compellingly illustrates the connections between these major financial collapses and examines the solid, clear-cut lessons they offer for preventing the next one., “Excellent.” — Wall Street Journal “My hands-down financial book of the year. . . . An incredibly rich mine of market history. . . . Enlightening. . . . Meticulous. . . . Definitive. . . . Absolutely first class.” — Financial Advisor Magazine Clearly and compellingly illustrates the connections between major financial collapses, and examines the solid, clear-cut lessons they offer for preventing the next one The stories behind the biggest stock market crashes in US history are rife with drama, human folly, and heroic rescues. Taken together, the pendulum swings between the larger story of a nation reaching enormous heights of financial power while experiencing precipitous dips that devastate a market where millions of Americans invest their savings, and on which they depend for their retirement, children’s education, and long-term financial well-being. CNBC contributor, longtime stock trader, and financial engineer Scott Nations vividly shows how each of these major crashes played a role in America’s political and cultural fabric, each providing painful lessons that have strengthened us and helped us to build the nation we know today. The Big Five financial crises covered: The Panic of 1907: When the Knickerbocker Trust Company failed, after a brazen attempt to manipulate the stock market led to a disastrous run on the banks, the Dow lost nearly half its value in weeks. Only billionaire J.P. Morgan was able to save the stock market. Black Tuesday (1929): As the newly created Federal Reserve System repeatedly adjusted interest rates in all the wrong ways, investment trusts, the darlings of that decade, became the catalyst that caused the bubble to burst, and the Dow fell dramatically, leading swiftly to the Great Depression. Black Monday (1987): When “portfolio insurance,” a new tool meant to protect investments, instead led to increased losses, and corporate raiders drove stock prices above their real values, the Dow dropped an astonishing 22.6 percent in one day. The Great Recession (2008): As homeowners began defaulting on mortgages, investment portfolios that contained them collapsed, bringing the nation’s largest banks, much of the economy, and the stock market down with them. The Flash Crash (2010): When one investment manager, using a runaway computer algorithm that was dangerously unstable and poorly understood, reacted to the economic turmoil in Greece, the stock market took an unprecedentedly sudden plunge, with the Dow shedding 998.5 points (roughly a trillion dollars in valuation) in just minutes.

LC Classification Number

HB3722

Price : 15.30

Ends on : N/A

View on eBay